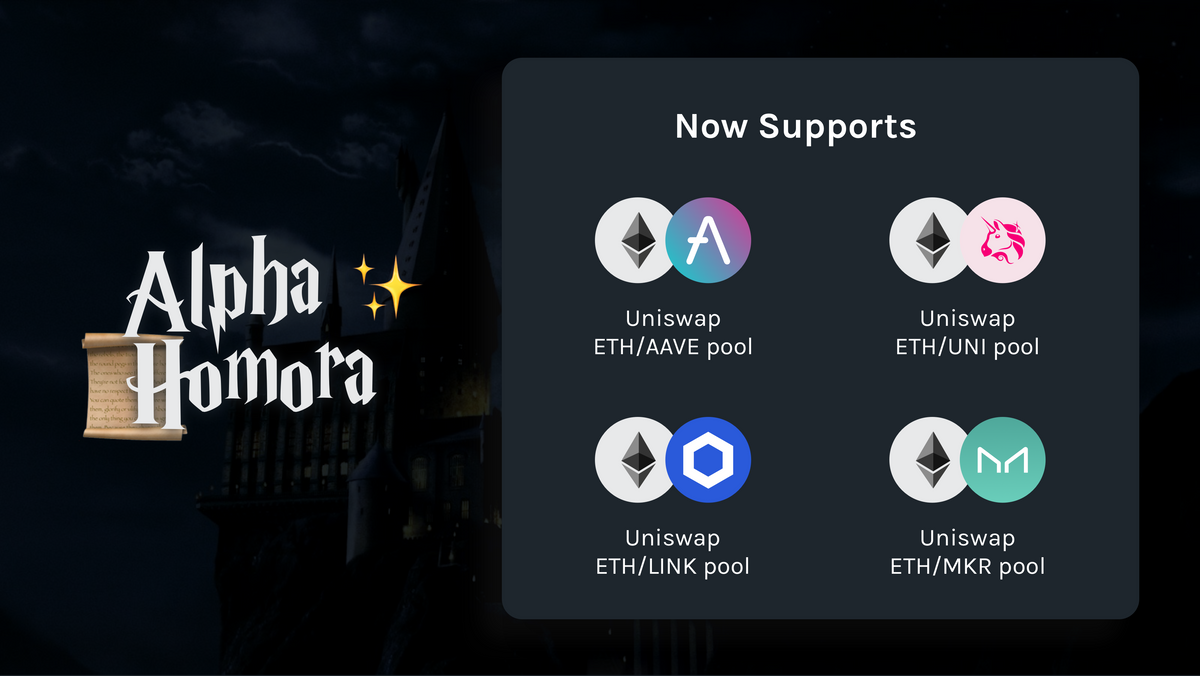

Alpha Homora Adds "Leveraged Liquidity Providing" for AAVE, LINK, MKR, and UNI Pools

Welcome AAVE, LINK, MKR, and UNI communities to Alpha Homora, as we now support liquidity providing on 2x leverage for ETH/AAVE, ETH/LINK, ETH/MKR, and ETH/UNI pairs on Uniswap!

What does it mean to provide liquidity on leverage and why would you want to do it?

It means Alpha Homora is borrowing some ETH and providing liquidity (both ETH borrowed and the tokens you supply) to the relevant pool on Uniswap for you.

By using Alpha Homora to provide liquidity on leverage, you can get more trading fees than providing liquidity normally.

Below shows how “liquidity providing on leverage” works. An example below is for ETH/LINK pool.

If you don’t want to take on leverage, how is this different from providing liquidity directly on Uniswap?

- Alpha Homora allows you to provide liquidity to Uniswap with just AAVE, LINK, MKR, or UNI, without needing to have these tokens and ETH in equal value.

- Alpha Homora can achieve this because it will automatically and optimally swap another token to ETH or vice versa to make sure you have both assets in equal value. Hence, you will be at capital efficient when supplying liquidity to Uniswap.

Risks

When opening a position on leverage, you are borrowing ETH. Some of the ETH borrowed is being swapped to another token (sold to buy another token), so you have both assets in equal value to supply to Uniswap. Hence, by opening a position on leverage, you are effectively shorting some ETH. As a result, your position value can decrease when ETH price goes up and increase when ETH price goes down.

For detailed step-by-step on how to farm, see here. If you want to read more about Alpha Homora, see our documentation here.

About Alpha Finance Lab

Alpha Finance Lab is an ecosystem of cross-chain DeFi products that will interoperate to bring optimal alpha returns to users. Alpha products focus on capturing unaddressed demand in DeFi in an innovative and user friendly way.

Alpha Homora, which is on Ethereum, is a protocol for leveraging your position in yield farming pools. ETH lenders can earn high interest on ETH, and yield farmers can get even higher farming APY from taking on leveraged positions.