🧙♀️ Alpha Homora ✨

Unlock your Yield Farming Potential. ✨🔓

Alpha team is excited to announce our first Alpha product on Ethereum - Alpha Homora. Alpha Homora will unlock your alpha through yield farming with leverage!

Alpha Homora's smart contract,, which is reviewed by PeckShield, can be found here. Alpha Homora will be launched on Thursday Oct. 8 @ 1.30pm UTC on Ethereum network.

Let the magic begin! 🎩

Alpha Homora is a protocol for leveraging your position in yield farming pools, or "dYdX for yield farming."

Supported pools on Uniswap:

- WETH/WBTC

- WETH/USDT

- WETH/USDC

- WETH/DAI

Supported pools on IndexCoop:

- WETH/DPI

Protocol Users 👤

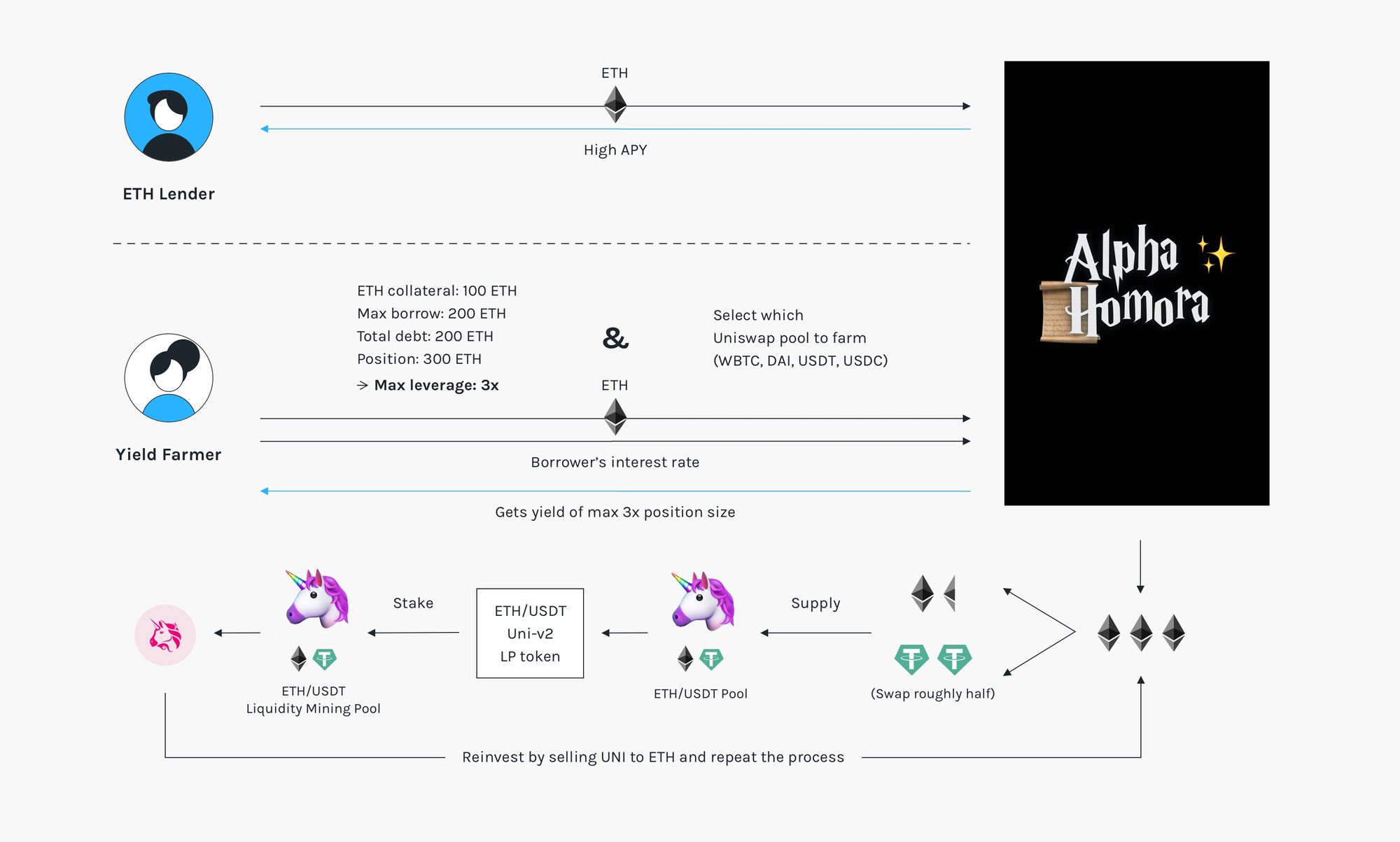

Users can participate in Alpha Homora protocol as yield farmers, ETH lenders, liquidators, or bounty hunters. Here is a short description of each user type:

- Yield Farmers seeking to open yield farming positions up to 2.5x their initial portfolio sizes. 🧙🔓

- ETH lenders seeking to earn interests on their ETH holdings. 🧙⬆️

- Liquidators seeking to earn 5% liquidation bonus on liquidating positions at risk. 🧙💥

- Bounty hunters seeking to earn 3% bounty of the total rewards for re-investing Alpha Homora portfolio. 🧙💰💰

Yield Farmers 🧙 🔓

UP TO 2.5x LEVERAGE: Users can borrow ETH with up to 2.5x leverage to yield farm on supported Uniswap pool.

AUTO RE-INVEST: All the yield farmed tokens will be automatically converted to add onto users' positions every 24 hours. This makes sure all yields are reinvested to further maximize everyone's profit.

HIGH DEBT RATIO SOLVENCY: Position stays solvent as long as the debt is worth less than killFactor (80% for Uniswap pools and 60% for IndexCoop pool) of the position value. For example, if a user farms on ETH-USDT with 3x leverage with ETH@$400, then the user’s position will be at liquidation risk when ETH price hits approximately $576*.

*Note: This assumes no slippage. A more detailed analysis for larger volume position will be included in future articles!

ADJUSTABLE POSITIONS: Users can at any time choose to adjust their positions by adding more ETH or taking some or all ETH out. Any action is acceptable as long as the result position has debt no more than 70% of position value.

Example yield farmer Alice:

- Alice has 100 ETH and wants to farm UNI on ETH-USDT Uniswap pool, where she can normally earn 30% APY. Normally, she can swap roughly half ETH to USDT then supply them to the pool and earn 30% APY (see our blog on how to do it optimally).

- With Alpha Homora, she can borrow 200 ETH from Alpha Homora Bank, paying the borrower's interest rate, and together with her initial 100 ETH, she can now farm with 300 ETH (3x leverage!) -- earning a total yield of 90% APY, TRIPLE! the amount of her original annual yield.*

- Without any further deposit, she can continue farming as long as her position value does not drop below 250 ETH.

*Note: Alice also needs to pay the borrowing interest on the borrowed amount, which depends on the ETH utilization rate.

ETH Lenders 🧙 ⬆️

INTEREST BEARING ETH (ibETH): When users deposit ETH to Alpha Homora Bank, they receive a proportional amount of ibETH token, a tradable and interest-bearing asset that represents their shares of ETH in the bank pool, similar to cToken in Compound.

EARN INTEREST: Interest paid by ETH borrowers* are distributed to ETH lenders, proportionate to the amount of ETH lent.** Lenders' interest rate depends on ETH utilization rate; the higher the the utilization, the higher the interest rate.

*Note: Borrower's interest rate model follows triple-slope-curve.

**Note: 10% of borrower's interest will be stored in Alpha Homora Bank Reserves, which can be used as an insurance fund for lenders in case of unexpected scenarios. In the future, Alpha Homora Bank Reserve authority may transition to community governance.

Liquidators 🧙💥

LIQUIDATION BONUS: Liquidators earn 5% of the position value for liquidating positions at risk (debt exceeding killFactor of the position's value).

Example liquidator Charlie:

- Bob leveraged 3x by borrowing 200ETH with his initial 100 ETH to farm UNI on ETH-USDT Uniswap pool. Bob's total position value is currently 300ETH.

- Later that week, there's a significant increase in ETH. As a result, Bob's total position value dropped from 300 ETH to️ 240 ETH, leaving his debt at 83.33% (200 ETH/240 ETH), which is higher than the

killFactorof ETH-USDT pool (80%). Charlie sees this opportunity and liquidates Bob's position, earning 12 ETH (5% of 240 ETH).

Bounty Hunters 🧙💰💰

REINVEST BOUNTY: Bounty hunters can call reinvest function to sell all yield farmed tokens in Alpha Homora portfolio for ETH, and reinvest into the yield farming pool, earning 3% of the total reward in the process!

Risks❗️

Like any borrowing with leverage, Alpha Homora has its own risk. Below is the outline of some risks each protocol users may face.

- Yield Farmers take the risk of being liquidated, specifically when the farming token price drops significantly (compared to ETH).

- ETH Lenders share the risk of debts accrued by underwater positions in case liquidators did not liquidate in time.

- Liquidators & Bounty Hunters take the risk of being front-run by other competitors, to get reward bonus from liquidations or reinvest bounties. If front-run, liquidators and bounty hunters pay gas fees for free (likely at high gas prices).

A more detailed risk analysis will be analyzed in future articles!

Key Parameters 🗝

Below are the values of Alpha Homora parameters, balancing between risks and rewards of our users:

Global Parameters

| Name | Value | Function | Description |

|---|---|---|---|

| Minimum Debt Size | 2 ETH | minDebtSize() |

The minimum borrowing amount (if borrowed any) for opening a position. |

| Borrowing Interest Rate | 10%-100% APY* | getInterestRate() |

Borrower’s interest rate to be paid, accrued per second. |

| Reserve pool rate | 10% | getReservePoolBps() |

Portion of borrower’s interest to be stored in bank’s reserve. |

| Liquidation bonus | 5% | getKillBps() |

Portion of position value the liquidator gets as an incentive to liquidate positions at risk. |

*Note: Borrowing interest rate follows a triple-slope-curve. See more details here.

Pool-specific Parameters

| Name | Value | Function | Description |

|---|---|---|---|

| Reinvest Reward Bounty | 3% | Inside Goblin contract | Incentive reward for bounty hunters calling reinvest function. |

| Max Debt Ratio | 70%** | workFactor() |

Maximum debt ratio when opening/adjusting a position. |

| Liquidation Debt Ratio | 80%** | killFactor() |

Debt ratio threshold. If exceeded, anyone can liquidate the position. |

We may adjust these initial values accordingly. In the future, the control of these parameters will be transitioned to Alpha community governance, where ALPHA holders can propose and vote for any changes to these values.

**Note: For the 4 Uniswap pools, Max Debt Ratio is 70% and Liquidation Debt Ratio is 80%. For WETH/DPI pool on IndexCoop, Max Debt Ratio is 33.33% and Liquidation Debt Ratio is 60%.

Liquidity Mining ⛏

A total of 2.5M ALPHA will be distributed to protocol users across 30 days, based on how much they us the protocol (75% to lenders, 25% to borrowers). Usage stats will be collectec from Thursday Oct. 9th @ 12:00pm UTC to Sunday November 8th 12:00PM UTC. Users can claim ALPHA reward only at the end of the liquidity mining period (i.e. November 8th 12:00PM UTC).

Protocol Governance 🏛

As with other Alpha products, ALPHA tokens will be the core governance of Alpha Homora protocol too.

ALPHA token will be listed on Binance starting on 10 October 2020 at 05:00 AM (UTC). See here for more details on participating in Binance Launchpad and Binance Launchpool.

ALPHA Utility

- Utility token for all Alpha products (e.g. provide liquidity or stake to receive % protocol fees)

- Main token to leverage Alpha products interoperability (e.g. users need to stake ALPHA in order to unlock interoperability features between Alpha Lending and Alpha Homora)

- 2-Level Governance: product-level and Alpha Finance-level.

a. Product-level governance will allow ALPHA token holders to govern key metrics of specific Alpha products. In the case of Alpha Homora, the metrics that the token holders can vote to set include protocol key parameters, modification to existing strategies, addition/removal of strategies to new farming pools, etc.

b. Alpha Finance-level governance will be implemented in the second phase and will allow ALPHA token holders to govern how the portfolio of Alpha products interoperate. For example, token holders can vote on whether they allow the use of alToken* received on Alpha Lending to be used on Alpha Homora.

Currently, these utilities are in the development process. We will share more details soon through our Blog and announcement.

*Note: alToken is an interest-bearing ERC-20 token that represents the user’s share of the deposited underlying asset.

Code Review 🛡

Thank you PeckShield team for working together with us on this code review. More details here.

Joining as Beta Testers 👩🔬👨🔬

Feeling excited about this product and curious on what's more to come? Interested in joining as beta testers?

Fill out this form, and we'll get back to you!

About Alpha

Alpha Finance Lab is an ecosystem of DeFi products, starting on Binance Smart Chain and Ethereum. Alpha Finance Lab is focused on building an ecosystem of automated yield-maximizing Alpha products that interoperate to bring optimal alpha to users on a cross-chain level.

We are moving at a rapid pace, so we encourage everyone to join our Discord for the latest updates, follow us on Twitter, or read more about us on our Blog!