Alpha Homora V2 Adds Leveraged ETH/DAI Pools on Uniswap & Sushiswap

Alpha Homora V2 now supports leveraged yield farming of ETH/DAI pools on Uniswap and Sushiswap. These will be the last pool to migrate from Alpha Homora V1 to V2.

For simplicity, this blog will be broken down into the 5 parts below:

- For users in these pools on Alpha Homora V1

- Benefits of migrating positions and ibETH from V1 to V2

- For users who are new to Alpha Homora V2

- What do leveraged users gain from these leveraged pools? What are the risks?

- Remaining Pools on V1 will not be migrated over.

For users in these pools on Alpha Homora V1

The addition of these pools on Alpha Homora V2 means that leveraged yield farmers in these pools on Alpha Homora V1 can now start migrating their positions to V2 to earn ~2x the ALPHA rewards.

Benefits of migrating positions and ibETH from V1 to V2

Migrating positions

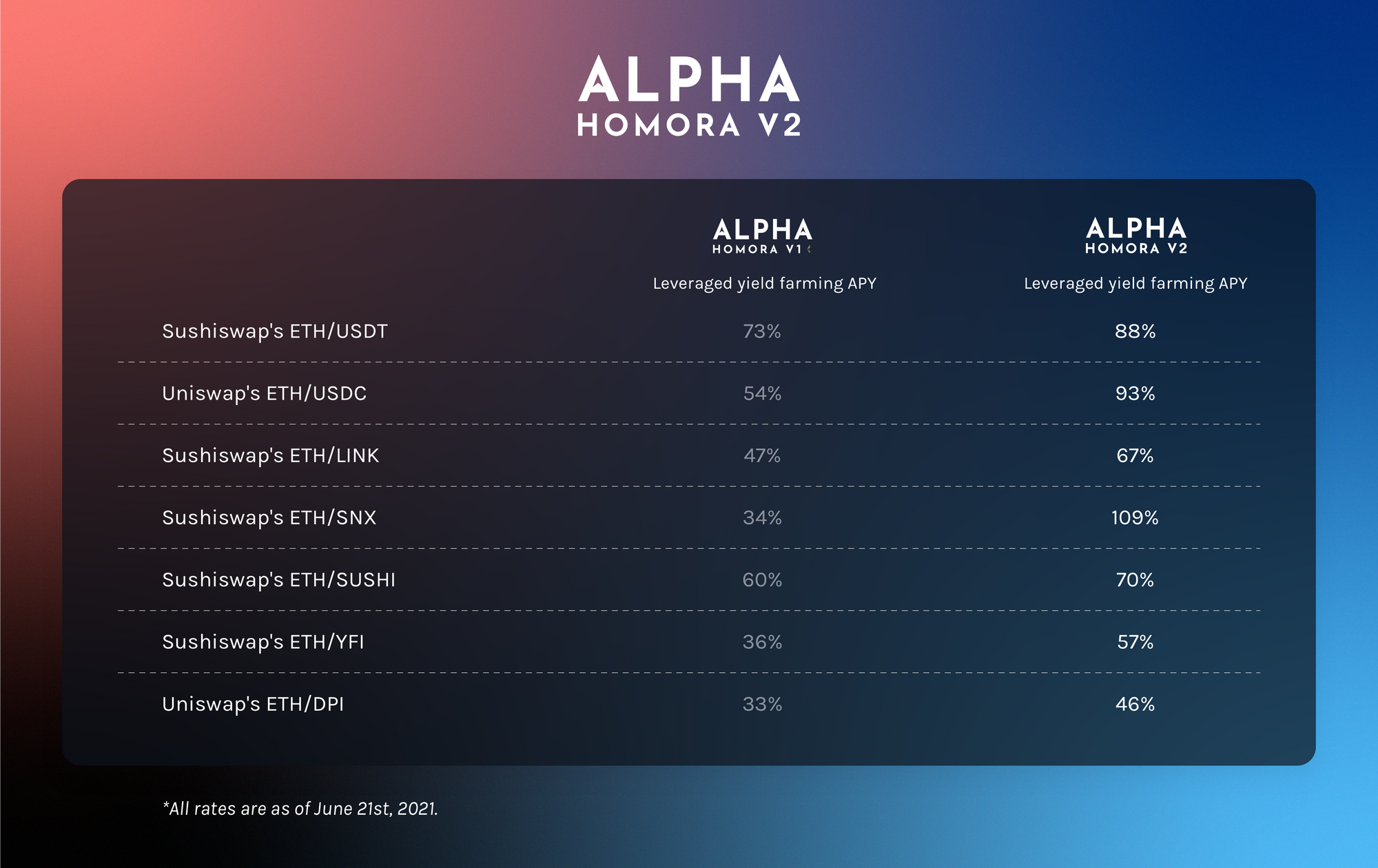

Besides having the additional ALPHA rewards, Alpha Homora V2 allows users to earn higher yields than on V1. Specifically, farmers on Alpha Homora V2 can borrow multiple assets, including stablecoins, in one position. This allows users to borrow the asset with a lower borrow APY and spread the borrow demand across multiple assets, thereby increasing the overall net yield.

To put things into perspective, here is a comparison of the yields between Alpha Homora V1 and Alpha Homora V2 for leveraged yield farmers:

To learn how to migrate, see the step-by-step guide here.

Migrating ibETH

Lenders who are lending ETH on Alpha Homora V1 should also migrate to lend ETH on Alpha Homora V2, as you will be earning ~6% on V2 as opposed to ~1% on V1.

To learn how to migrate, see the step-by-step guide here.

For users who are new to Alpha Homora V2

Alpha Homora V2 is a leveraged yield farming product that integrates with 4 AMM protocols - Uniswap, Sushiswap, Curve, and Balancer.

This means that the product adds leveraged functionality to the supported liquidity pools on the underlying AMM protocol.

As a result, the app’s user interface states the AMM name to make sure users know which pool and which AMM they are leveraged yield farming on.

For instance, if “Uniswap’s ETH/DAI pool” is selected, the transaction will be executed on the ETH/DAI pool on Uniswap.

To open a leveraged position on Alpha Homora V2, there are 3 main steps.

- Supply liquidity

- Borrow assets

- Read final summary before confirming the strategy

To see a step-by-step guide on how to open a leveraged position on Alpha Homora V2, see the product document here.

What do users gain from these leveraged pools? What are the risks?

What do users gain?

For Sushiswap's ETH/DAI, users on Alpha Homora V2 will:

- Earn SUSHI APY (higher APY than usual when opening a position of more than 1x leverage)

- Earn trading fees APY for providing liquidity to pools (higher APY than usual when opening a position of more than 1x leverage)

- Earn ALPHA liquidity mining rewards when opening a position of more than 1x leverage

- Optimized and automated leveraged yield farming/liquidity providing process for users

--> Users can supply only one token (no need to have both ETH and DAI)

--> If users have this pool’s LP token, users can supply the LP tokens as collateral

For Uniswap’s ETH/DAI pool, users on Alpha Homora V2 will:

- Earn trading fees APY for providing liquidity to pools (higher APY than usual when opening a position of more than 1x leverage)

- Earn ALPHA liquidity mining rewards when opening a position of more than 1x leverage

- Optimized and automated leveraged yield farming/liquidity providing process for users

--> Users can supply only one token (no need to have both ETH and DAI)

--> If users have the selected pool’s LP token, users can supply the LP tokens as collateral

To see a step-by-step guide on how to open a leveraged position on Alpha Homora V2, see the product document here.

What are the risks?

As with any borrowing with leverage, Alpha Homora V2 has its own risk. The below outlines the risks yield farmers may face on Alpha Homora V2.

For yield farmers/liquidity providers with no leverage (opening a position at 1x)

Users in this category are exposed to impermanent loss risk. Note that impermanent loss risk is minimal in a pool with all stablecoins (e.g. Curve 3pool that consists of USDT, USDC, and DAI)

For yield farmers/liquidity providers with leverage (opening a position with more than 1x)

Users in this category are exposed to impermanent loss risk. The impermanent loss risk is amplified by the leverage level that users enter at. Note that impermanent loss risk is minimal in a pool with all stablecoins (e.g. Curve 3pool that consists of USDT, USDC, and DAI)

Additionally, because of the impermanent loss risk + the fact that users are taking on leverage, users' positions also have liquidation risk.

Remaining pools on V1 will not be migrated

The ETH/DAI Pools for both Sushiswap and Uniswap are the last two pools that have been migrated from V1 to V2.

The remaining pools in V1 will not be migrated to Alpha Homora V2. We will inform the users again when the remaining pools will not be open for new users to farm. For those who are farming, you will be able to manage and close your positions still.

About Alpha Finance Lab

Alpha Finance Lab is a DeFi Lab. Alpha Finance Lab is building the Alpha Universe. Alpha Universe includes the Alpha ecosystem, which consists of Alpha products that interoperate to maximize returns while minimizing risks for users, and other ecosystems incubated through the Alpha Launchpad incubator program.

Alpha Homora is Alpha Finance Lab’s first product and DeFi’s first leveraged yield farming product that also captures the market gap in lending, one of the key pillars of the financial system.

Join our Telegram/Discord for the latest updates, follow us on Twitter, or read more about us on our Blog and Document!