Announcing Alpha Venture DAO’s Fourth Incubated Project: TiTi Protocol

Introducing the fourth incubated project, TiTi Protocol, a decentralized, multi-asset reserve-backed, use-to-earn algorithmic stablecoin. With TiTi, users can access diversified and decentralized financial services based on the crypto-native stablecoin system and autonomous monetary policy.

The project has raised $3.5 million in funding from Spartan Group, SevenX Ventures, DeFi Alliance, Solidity Venture, and other VCs and individual investors. TiTi is the first stablecoin project incubated in the Alpha Venture DAO. The addition of TiTi to our incubate arm will help us fuel the growth and development of Web3 initiatives across multiple verticals.

In addition, our Alpha Wolves community will also be able to claim benefits from this expansion into the stablecoin landscape by obtaining TiTi tokens through staking ALPHA on Alpha Tokenomics when the TiTi token is live.

What is TiTi Protocol?

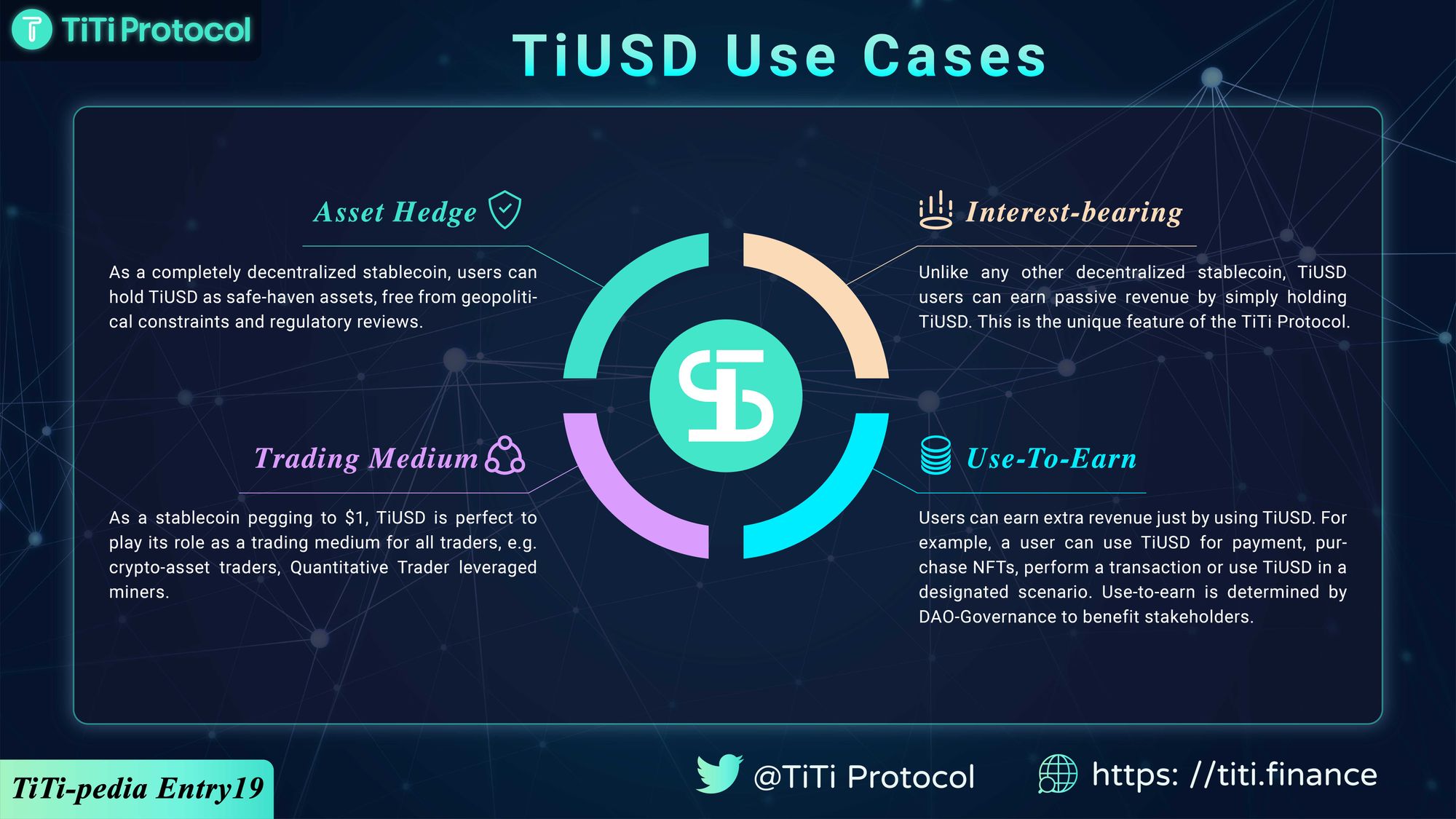

TiTi Protocol is a multi-asset reserve stablecoin based on a decentralized Auto Market Maker mechanism. TiUSD is the stablecoin issued by TiTi Protocol which can be used as an asset hedge, interest-bearing, or a trading medium. TiTi Proctocol's vision is to become a game-breaker in the stablecoin industry and create a new paradigm of algorithmic stablecoins to the DeFi and Web3 space.

By creating a new paradigm, TiTi has achieved an innovative balance of stability and growth. To achieve this, TiTi has introduced 3 unique features: multi-asset reserve issuance, use-to-earn, and reorders.

- The protocol has its own Auto Market Makers (M-AMMs) and is fully Multi-Asset Reserve backed, greatly ensuring the price stability of the TiUSD. Users can mint or redeem the collateral through its M-AMMs with multiple crypto assets. With multiple mainstream crypto assets as collateral, this will help break the ceiling for stablecoin issuance while others can not.

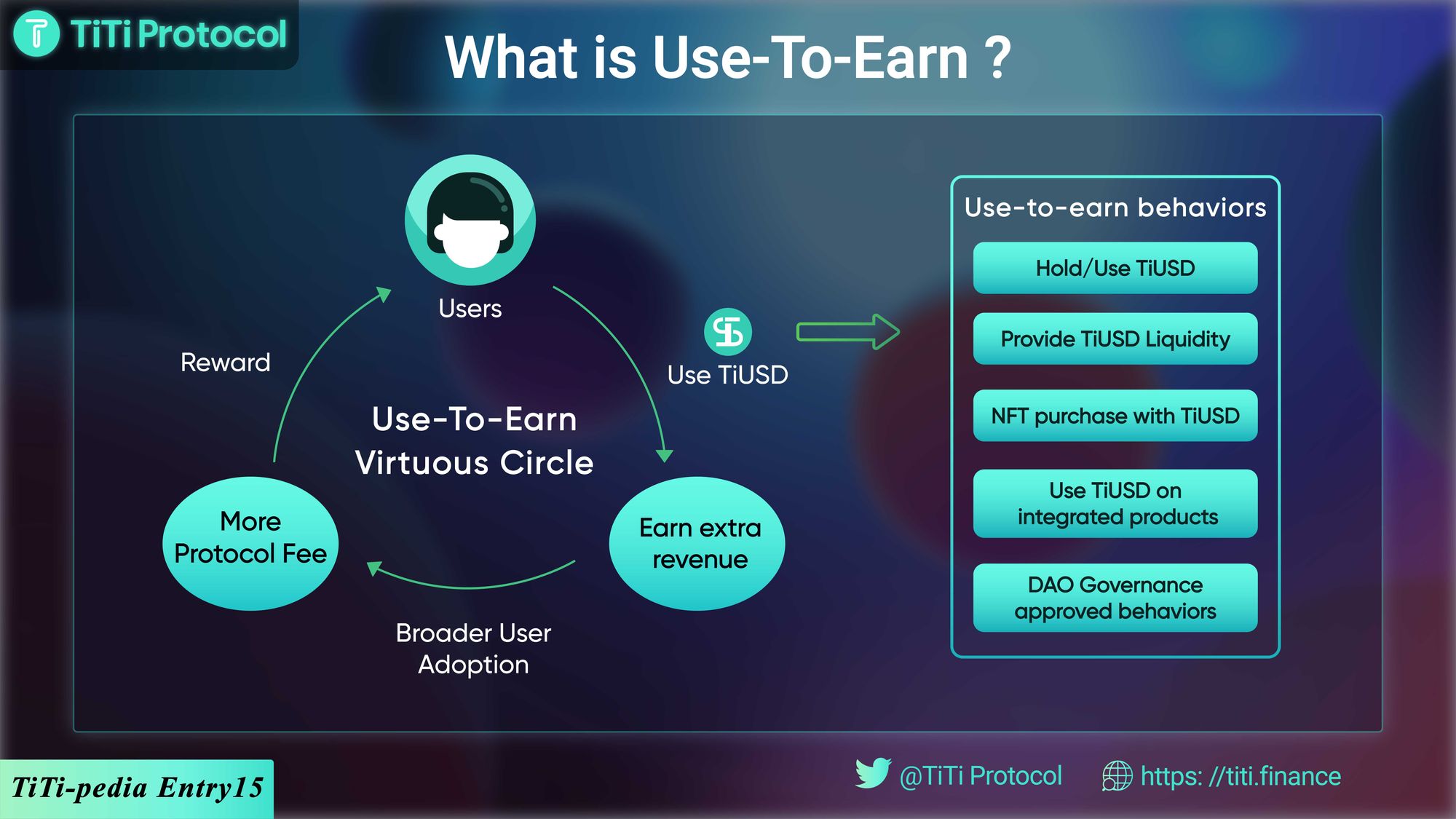

- The Use-To-Earn system allows users to earn both passive and positive revenue or rewards by simply holding or using the stablecoin issued by our protocol. For instance, users can use TiUSD to buy NFT, stake TiUSD to an external DeFi product, perform a transaction or use TiUSD in a designated scenario. Use-to-earn is determined by DAO-Governance to benefit stakeholders.

The system can collect fees and capture value by the Protocol Reserve from other yield farming aggregators. Most of the parts are used to reward TiUSD users. Users will be incentivised to use TiUSD more often due to higher revenue. As a result, TiUSD will enjoy a higher cap, transaction volume and large holder base.

The mechanism increases the utility of TiUSD token and so guarantees the long-term growth of the protocol. This maximizes the benefits of DeFi users and enables the interoperability of algorithmic stablecoins with other DeFi projects.

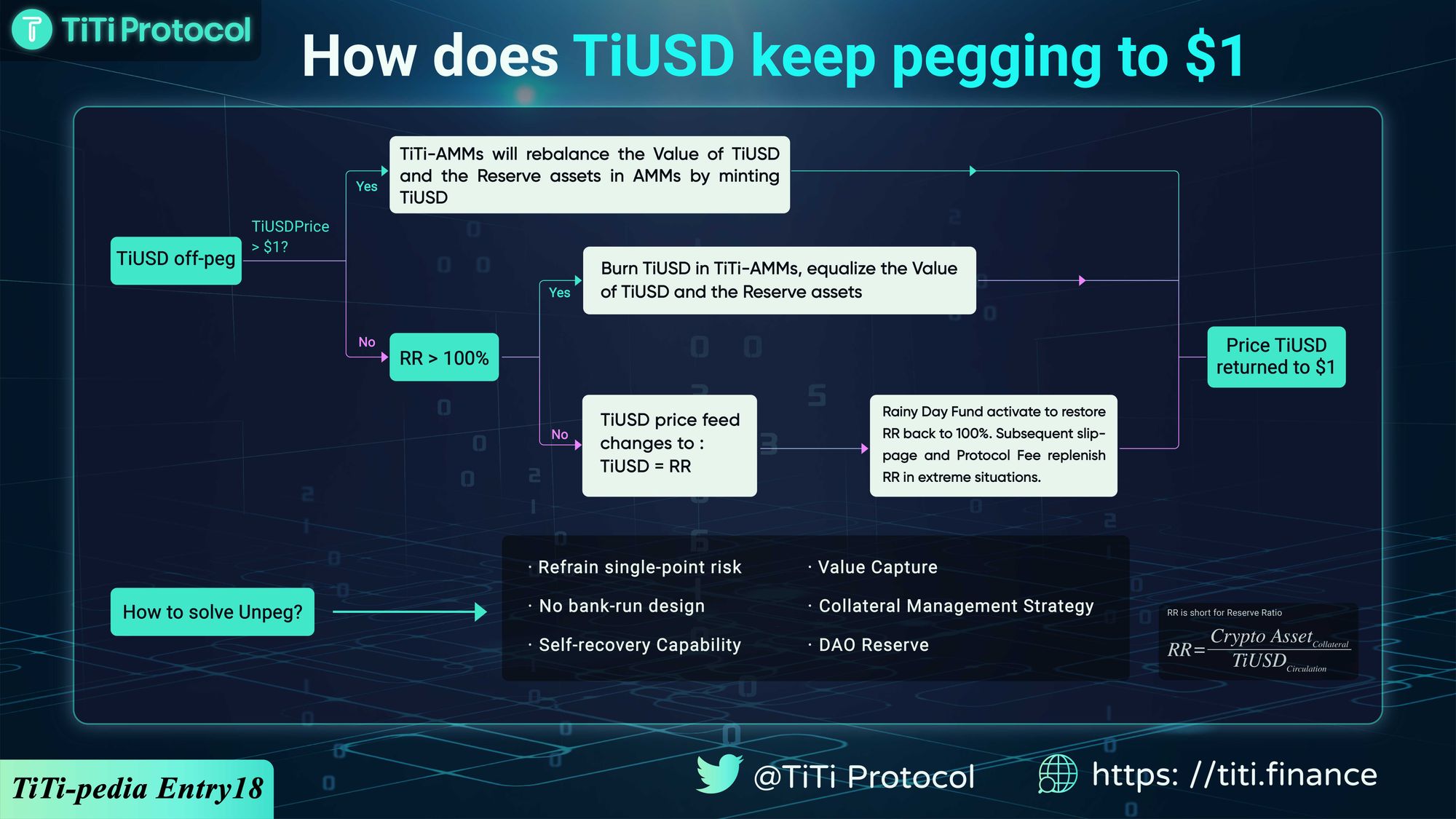

- Reorders is the pegging system in TiTi protocol that keeps TiUSD pegging to $1 by adjusting the supply of TiUSD in M-AMM. ReOrders has two core functions:

- By adjusting the number of TiUSD in TiTi AMMs, Reorders can rebalance TiUSD and another token in AMMs so that the price of TiUSD is always kept at $1 in due time.

- If TiUSD is too cheap, the protocol will take out TiUSD off the pool

- If TiUSD is too expensive, the protocol will deposit more TiUSD to the pool

2. By adjusting the number of Reserve Tokens in TiTi AMMs, Reorders can collect slippage during a market-making cycle.

As TiTi continues to accept more and more crypto assets as reserves, the corresponding TiTi AMMs will have more and more trading pairs, such as TiUSD-ETH, TiUSD-COMP, TiUSD-Alpha, etc. This will further increase the value of TiUSD as a trading medium.

What Problem Does TiTi Solve

Presently, the biggest pain point of the algorithmic stablecoin market is its low adoption, which is the main reason for its low market value. The reasons for this are as follows:

- Complex use with low capital utilization

- Stability is vulnerable to attacks

- Poor liquidity

- Volatility risks

TiTi manages to identify and address these challenges to boost the adoption of algorithm stablecoin in the DeFi and Web3 space by providing:

- Friendly User-Experience and High Capital Utilization

It's just like trading at any DEX. TiTi offers simple trading without having to worry about liquidation risk or low capital utilization since TiUSD uses a Reserve-based Protocol Controlled Value (PCV) mechanism.

2. Ultra-High Stability

The stability of the TiUSD token value can be guaranteed through the fully backed reserve assets. TiTi's Pegging system, Reorders, can adjust TiUSD market supply & demand liquidity in the utmost efficient way.

3. Ultra-High Liquidity

With the design of ‘Multi-Asset AMMs’, TiUSD will have high liquidity since users can swap TiUSD with diversified crypto-assets. In TiUSD, all reserve assets will be used as the liquidity provision of TiTi AMMs.

4. Resistance to volatility risks

TiUSD has multiple assets as reserves to restrain the negative risks brought by volatile assets.

Alpha Incubate x TiTi Protocol

The market value of stablecoin has surged 17 times, from less than $11 billion in early 2020 to almost $190 billion currently. Previously, centralized stablecoins accounted for more than 91% of the entire stablecoin market. However, this figure has dropped to 78.9%. This indicates that decentralized algorithmic stablecoins have been eroding market share from centralized stablecoins and are becoming more widely accepted by users. We spotted this on-going trend and the huge potential in this market. Hence, we chose to incubate TiTi and cultivate the field of algorithmic stablecoins.

This is your chance to contribute to and own this high-quality project! Join our Discord here to contribute to this promising project through Alpha Contribute. TiTi has prepared several missions as well as highly valuable rewards like whitelisting exclusively for our Discord wolf community! Remember! The more you contribute, the more likely you will be shortlisted to join our Alpha Network!

Closing Thoughts

Alpha Incubate was introduced to ultimately grow the Alpha Universe and bring more value accrual to ALPHA stakers by distributing their tokens to the stakers who support our ecosystem. Along with the Alpha Network, we offer every incubated project with an effective business plan from all dynamic angles, whether it's the product-market fit, tech advice, or even fund-raising strategies. For any teams interested in applying for Alpha Incubator Program check out our application process here.

About Alpha Venture DAO (Previously Alpha Finance Lab)

A Builders’ DAO. We explore and innovate at the fringes of Web3 and drive significant value to Web3 users, and ultimately, alpha returns to the Alpha community.

Join our Telegram/Discord for the latest updates, follow us on Twitter, or read more about us on our Blog and Document!