The New AlphaX is Now Live on Public Testnet!

The NEW AlphaX is now live on public testnet!

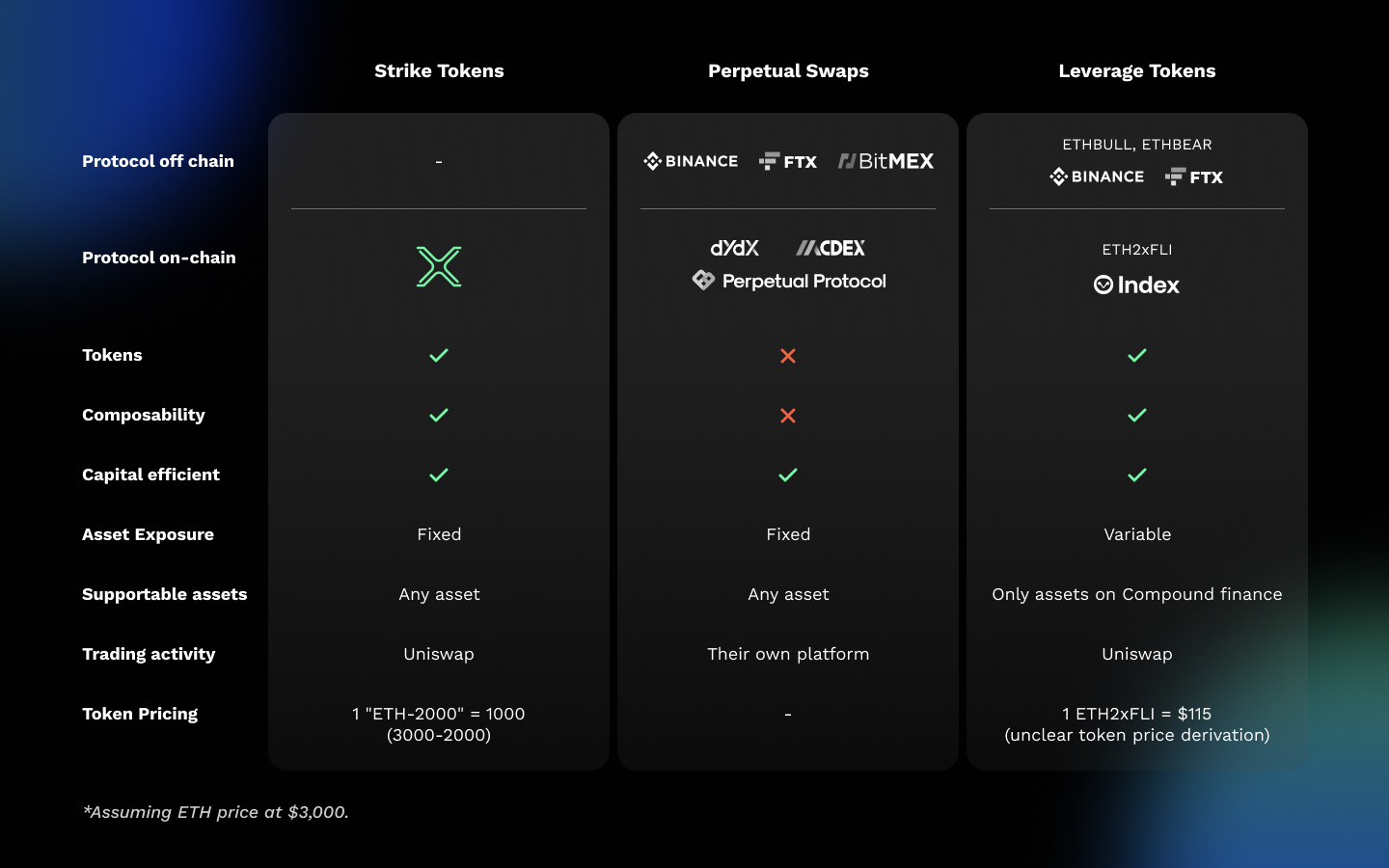

When taking a look at the current derivative trading concepts applied on-chain, there are 2 main concepts 1) perpetual swaps (e.g. dYdX, Perpetual Protocol, etc.) 2) leverage tokens (e.g. ETH2xFLI by IndexCoop although not exactly a derivative).

AlphaX combines the pros of both concepts while learning from the cons of each to create a completely new concept - Strike Tokens. Strike Tokens is a completely new take to trade derivatives in a capital-efficient way.

Strike Tokens vs. Other Concepts

The concept behind Strike Tokens

The Strike Tokens concept for AlphaX was coined and created by Alpha Finance Lab, so there are no same product offerings off-chain or on-chain. We believe that a DeFi-native product is needed to make the derivatives trading market skyrocket in DeFi, as it is in traditional finance.

With the Strike Tokens concept, AlphaX is designed to be very easy-to-use by any DeFi user and composable with any DeFi protocols on-chain.

How easy is it? It's as easy as asking yourself these 2 questions.

- Are you bullish or bearish in that particular asset?

- What do you think is the price floor (if you’re bullish) or ceiling (if bearish) of that asset? These price floor/price ceiling can be referred to as the strike price, and hence the concept name “Strike Tokens”.

Once you have these 2 answers, you are ready to use AlphaX.

How is AlphaX’s Strike Tokens concept a DeFi-native approach to derivatives trading?

1.Composable

AlphaX is composable with other DeFi products, offering even more profit and hedging strategies

2.Scalable

AlphaX can support any asset as long as there is a price feed

3.Easy to understand

a. There is no funding rate concept that users need to understand (exist in perpetual swaps)

b. There is no rebalancing concept that users need to understand (exist in leverage tokens)

c. Token price is easily derivable, as it’s a simple subtraction (e.g. ETH-1500 token price = 3,000-1500 = 1,500, assuming ETH price is $3,000)

4.Capital efficient

Buying 10 tokens of ETH-1500 gives user exposure to 10 ETH in a more capital-efficient way than buying 10 ETH on the market

What are Strike Tokens?

There are 2 types of Strike Tokens on AlphaX. Each Strike Token gives you an exposure to 1 unit of that asset.

ASSET-X

- Represents a long token

- X represents the price floor

- For instance, 1 “ETH-1500” token represents a long token and gives you exposure to 1 ETH in a more capital-efficient way. You will buy this token if you want to long ETH and think that the ETH price will not decrease to $1,500 (hence the price floor) during the time that you want to hold the token.

Y-ASSET

- Represents a short token

- Y represents the price ceiling.

- For instance, 1 “4500-ETH” token represents a short token and gives you exposure to shorting of 1 ETH in a more capital-efficient way. You will buy this token if you want to short ETH and think that the ETH price will not increase to $4,500 (hence the price ceiling) during the time that you want to hold the token.

AlphaX is a platform to mint and redeem these Strike tokens. Although users can easily buy and sell these tokens from AlphaX, the underlying trading activities take place on Uniswap V2.

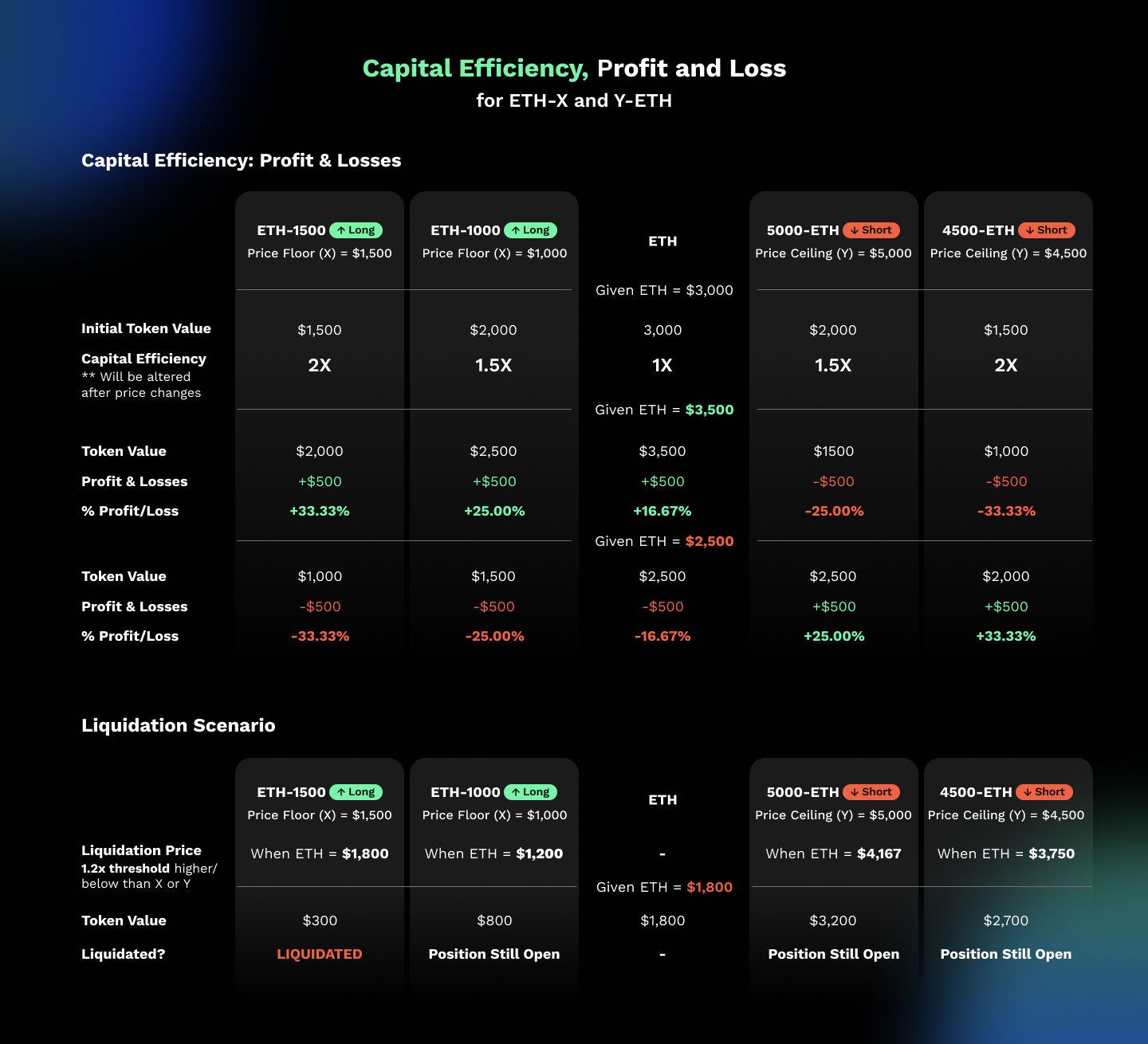

Capital efficiency, profit & losses

The Capital Efficiency, Profit and Loss table depicts example cases where users hold ETH-Strike-Tokens of different levels, in comparison to just holding an ETH token.

For instance, ETH-1500 gives you an exposure to 1 ETH while requiring initial capital of $1,500 as opposed to $3,000 if you were to buy ETH on the market, resulting in higher capital efficiency and profit percentage (33.33% vs. 16.67% profit on investment).

Nevertheless, similar to Futures trading, having a capital efficiency higher than 1X also means higher losses if the market trend does not follow according to users’ plan. As shown in the table above, the ETH-1500 token will be liquidated if the ETH price decreases to $1,800 and the 4500-ETH will be liquidated when the ETH price increases to $3,750.

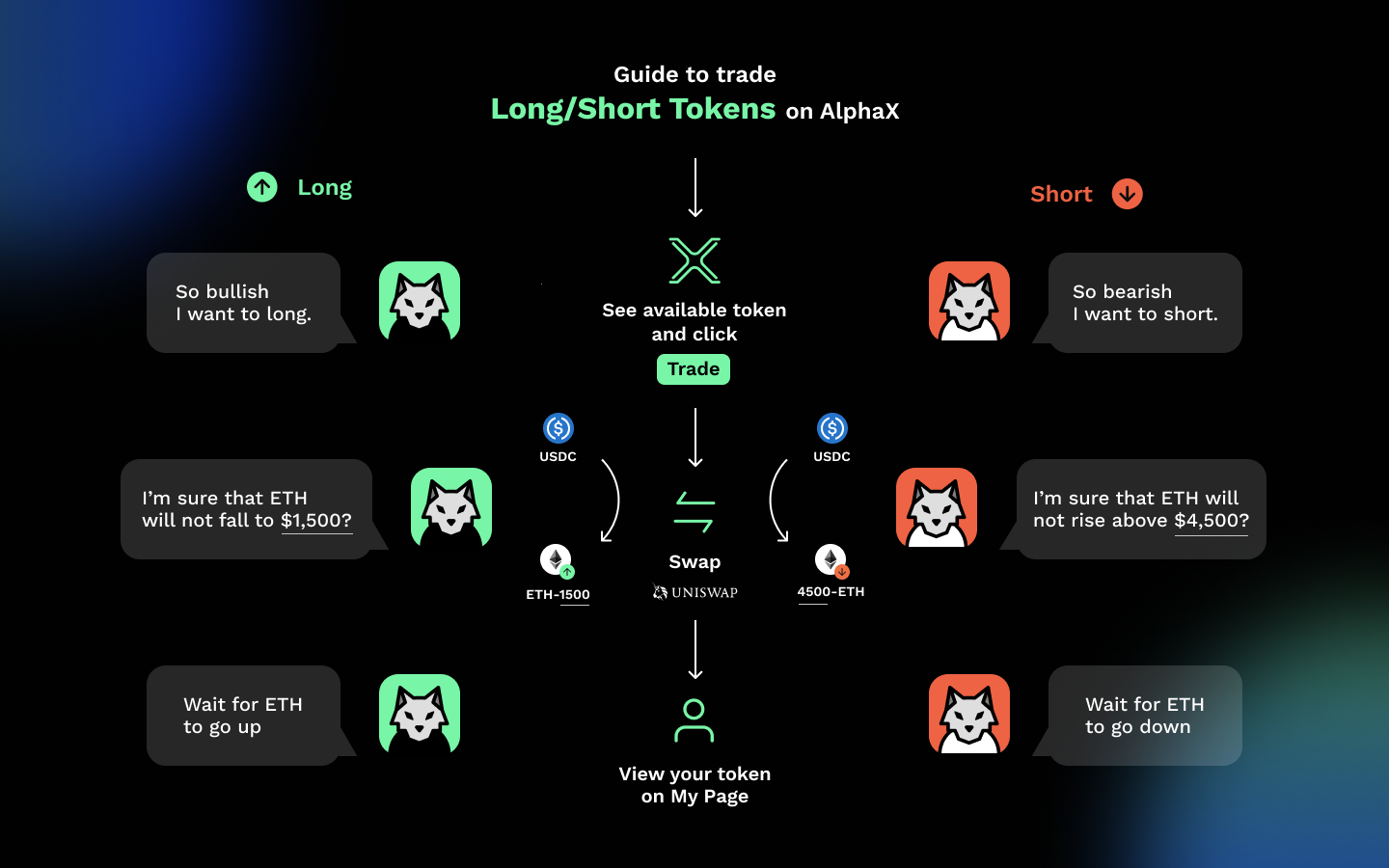

How to use AlphaX

Beginners guide for any DeFi user

To know which Strike Token to buy, simply ask yourself these 2 questions.

- Q1: Are you bullish or bearish in that particular asset?

- A1: Let’s say Alex is bullish on ETH

- Q2: What do you believe to be the price floor for the asset during the time you’re looking to hold the token?

- A2: Alex believes that the ETH price will not decrease to $1,500 (price floor).

Assuming Alex wants to get exposure to 10 ETH, he will then go to AlphaX to buy 10 tokens of “ETH-1500”. That’s it! Now Alex has exposure to 10 ETH in a more capital-efficient way because he’s spending lower initial capital than if he were to actually buy 10 ETH on the market.

Let’s do another example for short tokens.

- Q1: Are you bullish or bearish in that particular asset?

- A1: Let’s say Bob is bearish on ETH

- Q2: What do you believe to be the price ceiling for the asset during the time you’re looking to hold the token?

- A2: Bob believes that ETH price will not increase to $4,500 (price ceiling)

Assuming Bob wants to get exposure to shorting of 2 ETH, he will then go to AlphaX to buy 2 tokens of “4500-ETH”. Now Bob has exposure to shorting of 2 ETH in a more capital-efficient way.

For a step-by-step guide, check the documentation here.

NOTE: Strike Tokens can be liquidated when the asset price gets closer to the price floor/ceiling. For more information on liquidation risks, check here.

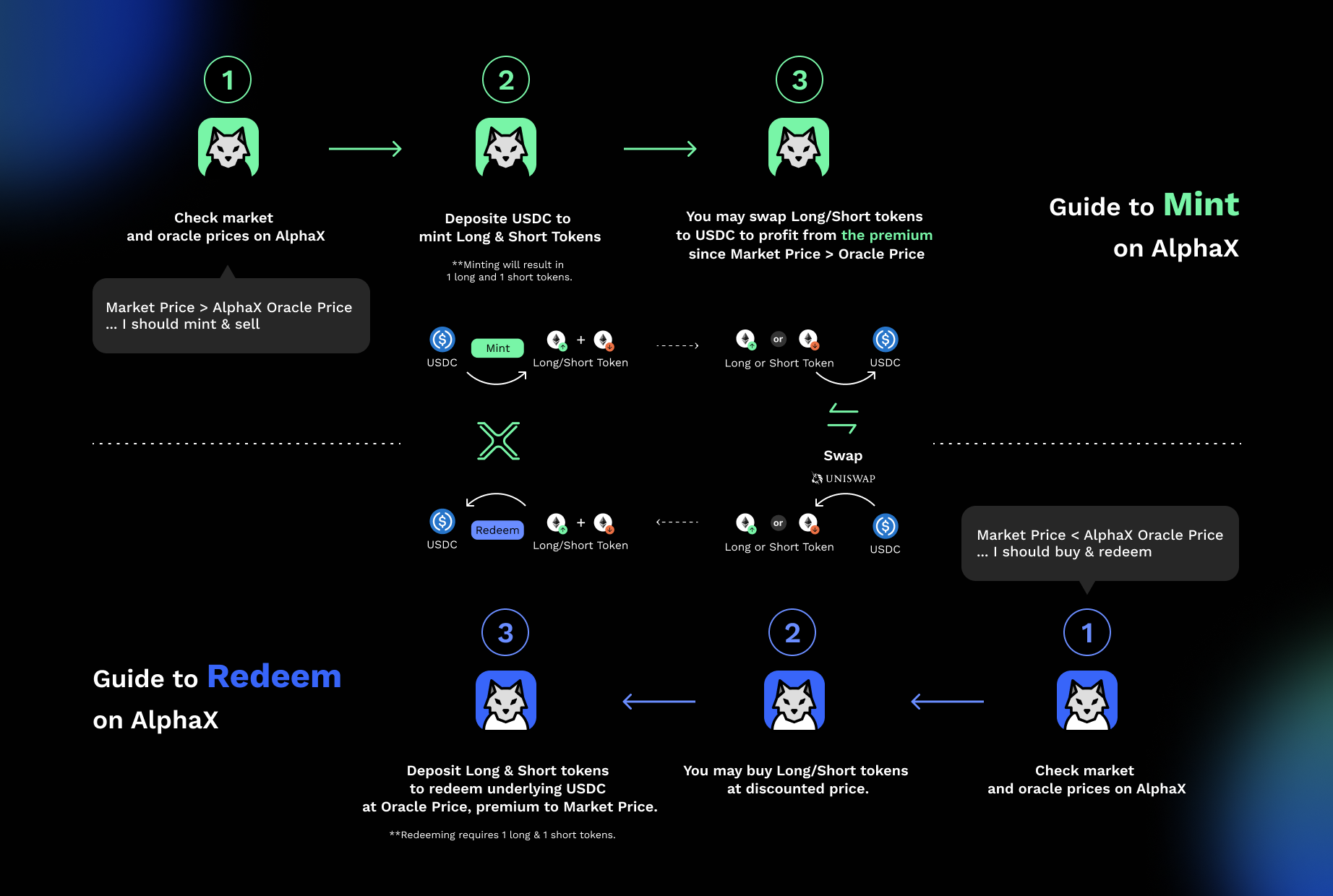

Advanced guide for experienced DeFi users

In addition to the Beginners Guide, advanced DeFi users have 2 more ways to profit from AlphaX when the market price and oracle prices deviate.

If market price > oracle price

- Users gain the difference by minting the Strike Tokens on AlphaX at oracle price (with mint function) and selling them on the market at market price (with trade function)

If market price < oracle price

- Users gain the difference by buying the Strike Tokens at market price (with trade function) and redeeming them on AlphaX at oracle price (with redeem function)

For a step-by-step guide, check the documentation here.

NOTE: Strike Tokens can be liquidated when the asset price gets closer to the price floor/ceiling. For more information on liquidation risks, check here.

Closing Thoughts

Alpha created a new concept once with leverage yield farming when we launched Alpha Homora. Now, we’re creating a new concept again with the launch of AlphaX. AlphaX is not a perpetual swap or a leverage token, but a completely new take to trade derivatives in a capital-efficient way.

In the past DeFi era, it's all about getting high yields, leading to the growth of yield aggregating and yield farming protocols. AlphaX's composability and the new concept of Strike Tokens will help kickstart a new growth angle of DeFi giving rise to hedging strategies and profit strategies built between AlphaX and other DeFi protocols.

Now the gate has officially opened, inviting the community to experience this innovation….Welcome to AlphaX!

About Alpha Finance Lab

Alpha Finance Lab is a DeFi Lab, and on a mission to build